New research shows Canadian parents are putting themselves under immense financial and emotional stress to provide monetary support for their children’s post-secondary education.

Our latest survey of over 1,000 parents across Canada found that while parents believe post-secondary education is extremely important for their child, the rising cost of living means that many are cutting out day-to-day necessities just to make ends meet and are unable to save as much as they had hoped for their child’s education. As a result, parents are choosing to provide financial support for their children at the cost of their own financial and mental well-being. Thankfully, there are key steps that parents can take to create a manageable education savings plan.

“Today’s parents are watching their children grow up during a difficult job market and volatile economic conditions, and they see how higher education can provide security for young adults,” said Andrew Lo, CEO and President of Embark. “Parents shouldn’t feel guilty if they haven’t started saving for their child’s education or have to go to extremes to give their child the tools they need to succeed. There are many things parents can do to set their children up with an education without taking on significant debt. At Embark, we help families achieve this daily, giving them the tools they need to manage their financial future, whether they’ve just had kids or already have teenagers.”

Parent’s Perspective on Post-Secondary Education

When it comes to post-secondary education, nearly 3-in-4 (73%) Canadian parents surveyed think that it is essential to their child’s future success. Consequently, 88 per cent would like their child to pursue a post-secondary education and over half (57%) would feel disappointed if their child had no interest in higher education.

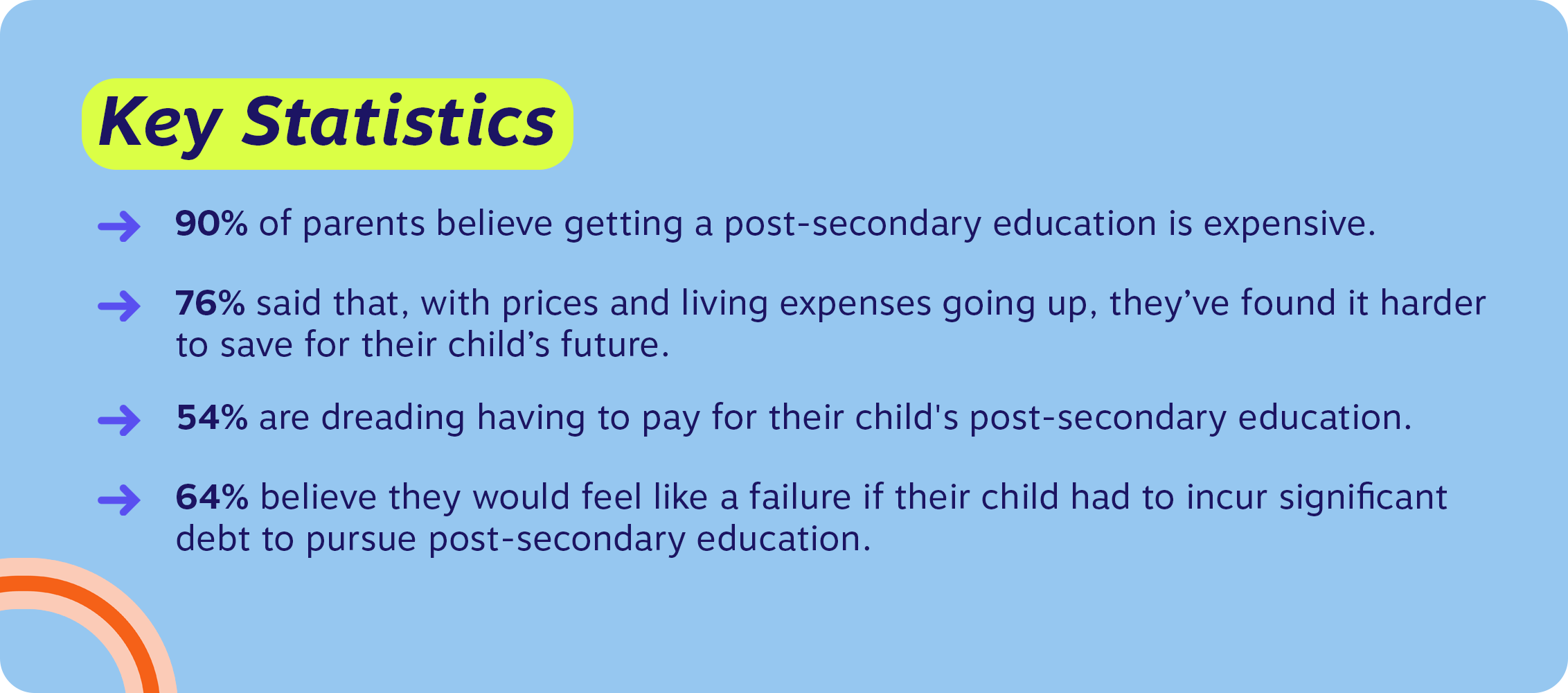

However, parents also understand that it is harder now for students to afford an education than when they were a child (82%), and 85 per cent noted that post-secondary education is becoming increasingly unaffordable. In fact, 88% of Canadian parents noted that the amount of debt students take on in order to get a post-secondary education can be debilitating, and 70 per cent do not believe their child would be able to afford an education without their help.

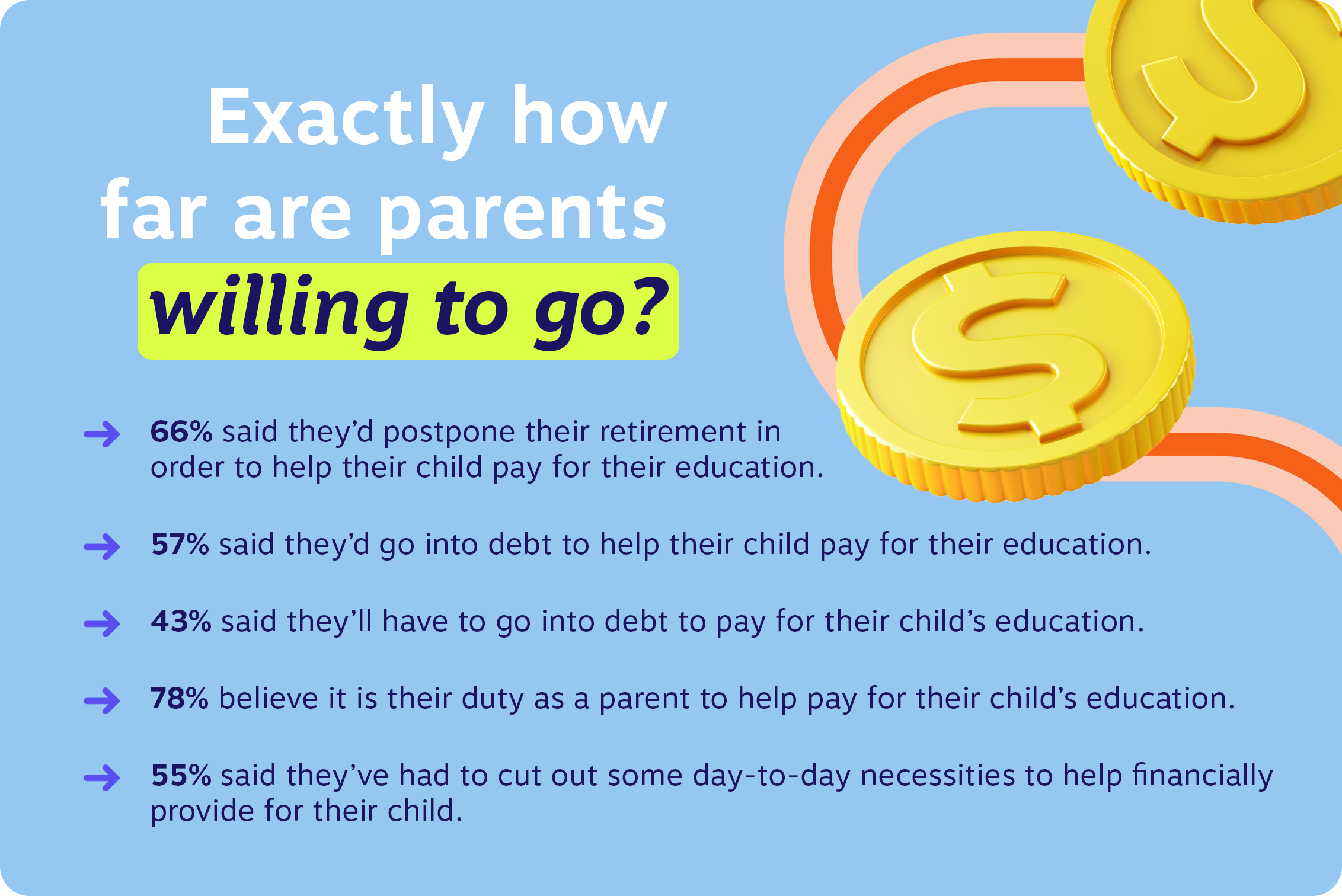

As a result, Canadian parents are putting significant pressure on themselves to provide their children with financial support – 82 per cent of parents feel like it is their responsibility to help their child pursue a post-secondary education. Furthermore, 73 per cent fear that their child’s options will be limited if they do not help them pay for their post-secondary education.

The Financial and Emotional Pressure of Education Savings on Parents

Education savings not only has a financial impact on parents, but it can become a serious emotional burden. More than two-thirds of parents (69%) worry about the amount of debt their child will incur as a result of their education, with 64 per cent claiming they would feel like a failure if their child had to incur significant debt to pursue a post-secondary education.

Unfortunately, saving as a whole has become more difficult with the rising cost of living. The vast majority of Canadian parents surveyed (87%) noted that increasing expenses have made it harder to save in general, and over half (56%) admitted they are currently living paycheque-to-paycheque.

The trickle down effect on education savings is that over 3-in-4 (76%) said that with prices and living expenses going up, they have found it harder to save for their child’s future. In fact, 46 per cent said they have had to stop saving for their child’s education because of how much everything is now costing, leading to 61 per cent worrying that they have not saved enough for their child’s post-secondary education.

The additional stressor of cost of living increases means parents are putting their own financial health on the backburner in order to provide support to their child. Nearly two-thirds (61 per cent) of Canadian parents believe supporting their child is more important than their own financial health, and 58 per cent would rather take on debt themselves than have their child take on debt in order to pursue a post-secondary education.

Click here to view national and provincial data related to the study.

How to Build Up Education Savings with Less Stress

Due to this intense responsibility parents are putting on themselves to give their children a better future, 68 per cent said saving for their child’s education can at times be overwhelming. Over half (54%) are dreading having to pay for their child’s post-secondary education.

However, there are resources to help parents plan ahead for their child’s education. By saving consistently and saving early, families can make things more manageable and often avoid taking on significant debt. Parents should not be expected to compromise on their own future and risk their financial health for their child.

“Right now, four years of undergraduate tuition in Canada costs roughly $30,000, depending on where you are in the country. If you and your partner both save $50 every month, you’ll have enough to cover this cost by the time your child turns 18, assuming a four per cent rate of return and all the government grants you’d get from saving in an RESP,” said Lo. “Whether your child was just born or is about to go to high school, even saving a little has the potential to become a lot over time. It’s very important just to start – and a great way to do so is with a registered education savings plan. It helps with tax-deferred growth and it can get you more money just for saving in one.”

The key is to create a realistic savings plan in advance, define achievable goals and communicate those goals with your children. In doing so, parents can save more comfortably, mitigate unexpected financial hiccups and allow their children to plan their pathway without incurring insurmountable debt.

Create a Savings Plan Early: Over half (52%) of respondents said they wish they started saving for their child’s post-secondary education sooner. Starting earlier typically makes saving more manageable. While the value does not have to be big, and can increase or decrease over time depending on needs and circumstances, consistently saving can have a very meaningful effect on helping you reach your goals.

Clearly Define Your Goals: From the parents surveyed, the average percentage of their child’s post-secondary education they are hoping to pay for is 67.2 per cent. To understand how much you need to save, you first need to know what you’ll need. Forecast the cost of your child’s education, what you’ll pay for and how much of it you’ll pay. From there, work back and understand how much you’ll need to save. Embark can help with this, their digital platform can project your child’s costs and help you define your goals. Try a lite version by visiting www.embark.ca/resp-calculator.

Communicate Costs with Your Child: 57 per cent of parents have not spoken to their child about how much of their post-secondary education they will help pay for, making it difficult for children to understand what their options are after high school. Speak with your child about your expectations of them, and what you’ll help them pay for as early as possible. This way, you can help them avoid debt by allowing them to properly plan and save for the journey.

Embark is Canada’s education savings and planning company. The organization aims to help families and students along their post-secondary journeys, giving them innovative tools and advice to take hold of their bright futures and succeed.