Save while you (don’t) sleep.

Being a parent means you’re always on. The Embark Student RESP is always on too. It’s the only RESP that adjusts to maximize savings as your child grows.

Open a new plan and get up to a $150 bonus with promo code EXTRA150.*

The easy way to RESP.

$0

upfront cost to get started1

7.85%

investment return in 2024 for the cohort with children born in

2009-20112

18.33%

investment return in 2024 for the cohort with children born in 2024–20262

Up to $7,200

or more in federal and provincial government grants3

Children grow fast.

Your RESP should too.4

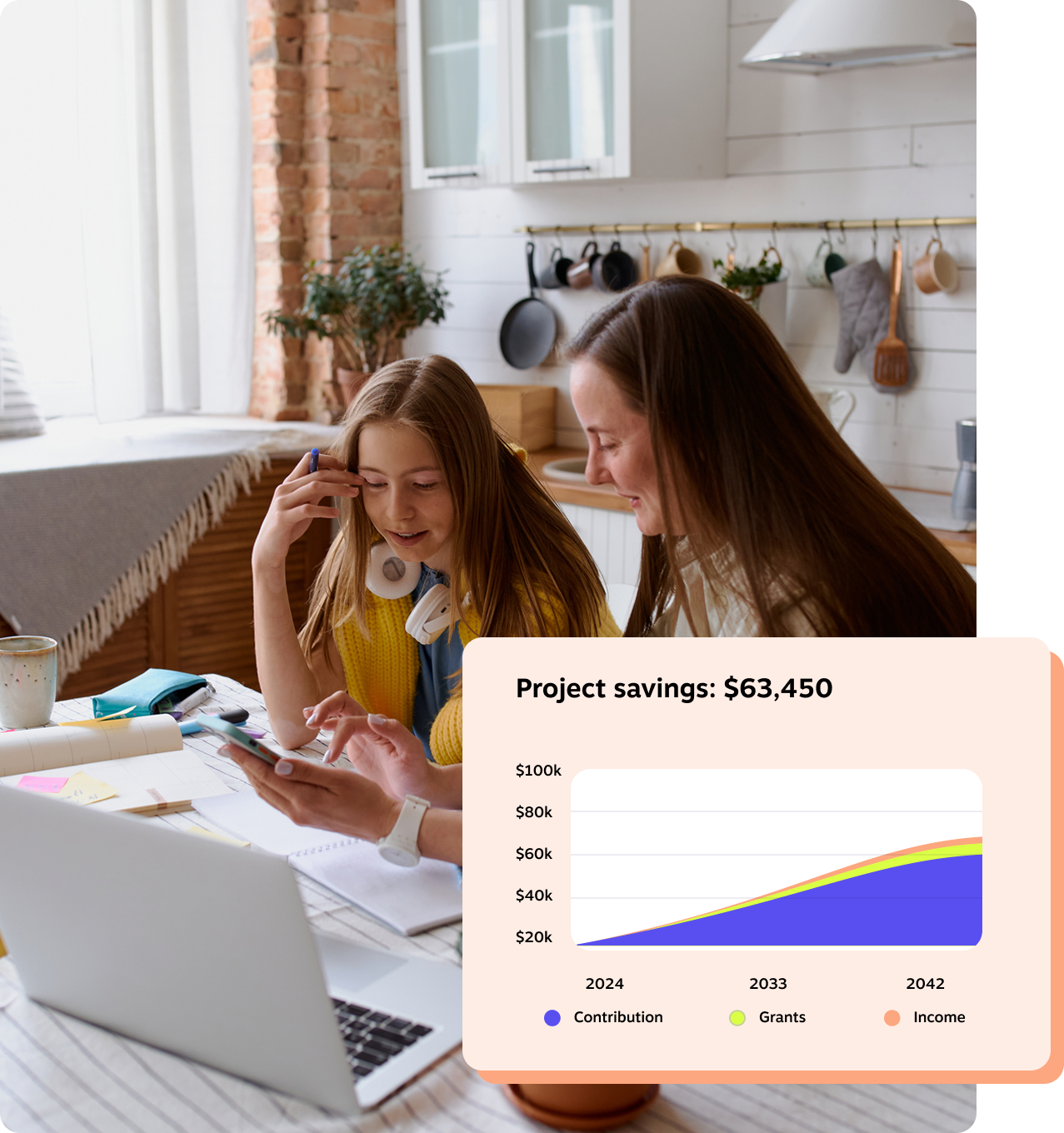

An RESP designed for your child’s future

An Embark RESP uses a Glidepath strategy, built to grow in the early years and aims to shelter savings as school gets closer. We’ll watch over your investment, while you focus on what really matters—raising your kids.

Automatic application for government grants

We help you get every government grant you qualify for. Add to your RESP and get a 20% match, up to $7,200 total (or more, depending on where you live).5 No money gets left behind.

A flexible RESP

Whether it’s every month or once a year, you set the deposit schedule that works for you and your budget. You can stop or change or withdraw contributions from home, anytime.6

Not all RESPs are created equal.

At Embark, we do one thing: helping you get the most out of your education savings.

| Embark | 5 big banks 9 | |

|---|---|---|

| 4.5+ stars on Google10 | ✓ | ✗ |

| Time to open | 8 minutes | 1 hour 11 |

| Minimum investment to open | $0 | $40012 |

| Investment fees | 1.65% | 2.02%13 |

| Glidepath investment14 | ✓ | ✗ |

| Intelligent alerts | ✓ | ✗ |

| Personalized goals | ✓ | ✗ |

| Friends & family can gift directly into RESP | ✓ | ✗ |

| Guided online withdrawals | ✓ | ✗ |

| Exclusive offers from our partners | ✓ | ✗ |

More than just another RESP.

Digital-first

No money left behind

RESP gifting

Flexible savings

Add as you grow

Exclusive offers

Featured on

What is a Glidepath strategy?

Our Registered Education Savings Plan (RESP) is designed to maximize growth potential in the early years and reduce risk as school approaches – so you can plan for their future with confidence.

Early Years

When your child is young, we focus on higher-growth investments to help build your savings.

Middle Years

As your child gets closer to high school, we gradually shift to a more balanced mix of growth and stability.

Final Years

As post-secondary approaches, we prioritize protecting your savings by moving into lower-risk investments.

Big futures, real costs.

Tuition & Books

The average cost of university tuition in Canada is $7,100 a year. Saving just $100 a month puts you on track to cover three years. And if they go to college instead? You’ll be covered.

Residence & Meals

Living on campus can cost up to $30,000 a year. Saving around $208 a month helps you maximize your grants, and could cover most of those residence costs.

Save for the unexpected

One year of college or eight years of university? We’ll help you build the right savings plan no matter what they choose.

Around 60% of Canadians save for tuition first and contribute an average of $100 a month7.

Today, you pack lunch.

Tomorrow, you pay tuition.

Most banks make withdrawing from your RESP complicated: Think paperwork, appointments, and endless waiting. But with Embark, accessing your savings is simple, smart, and stress-free.

Easy online withdrawals

Withdraw online anytime—no paperwork, no branch visits. Track your money in real time and know exactly when it’s arriving, so you can stay focused on what matters most.

Smart withdrawal strategies

We help you withdraw grants and earnings first, so your contributions last longer and you minimize taxes. More savings for them, fewer surprises for you.

Planning for every child

Have more than one child? No problem. We help you manage your RESP carefully so there’s enough for every child’s education.