Get up to $150 when you open a new RESP

Open a plan for a new beneficiary and get $50, plus earn $100 more when you contribute $100 within your first 3 months.*

Use code EXTRA150.

Registered Education Savings Plan (RESP)

What is an RESP?

An RESP (Registered Education Savings Plan) is a special savings account that helps parents save money for their child’s post-secondary education.

How does an RESP work?

Add to your RESP and get a 20% government match, up to $500 a year and $7,200 total per child. Your contributions and grants both get eligible interest. Bonus: it grows tax-free until you withdraw it.

Who is an RESP for?

An RESP is for anyone—parents, guardians, or family members—who wants to save for a child’s education, grow their savings, and take advantage of government grants.

Top choice of over

1 million Canadians

For 60 years, we’ve helped fund post-secondary education for students. Unlike traditional banks, we’re owned by a not-for-profit foundation that puts Canadian families first—reinvesting profits into scholarships to help even more students succeed.

- Managing $6.5 billion in assets

- 60 years of education savings expertise

- 60,000+ students supported every year

From CTV News

A quick look at RESP gifting

From CTV News

A quick look at RESP gifting

See how family and friends can send contributions directly into a child’s RESP with Embark’s digital gifting platform.

Have the money.

When it’s time.

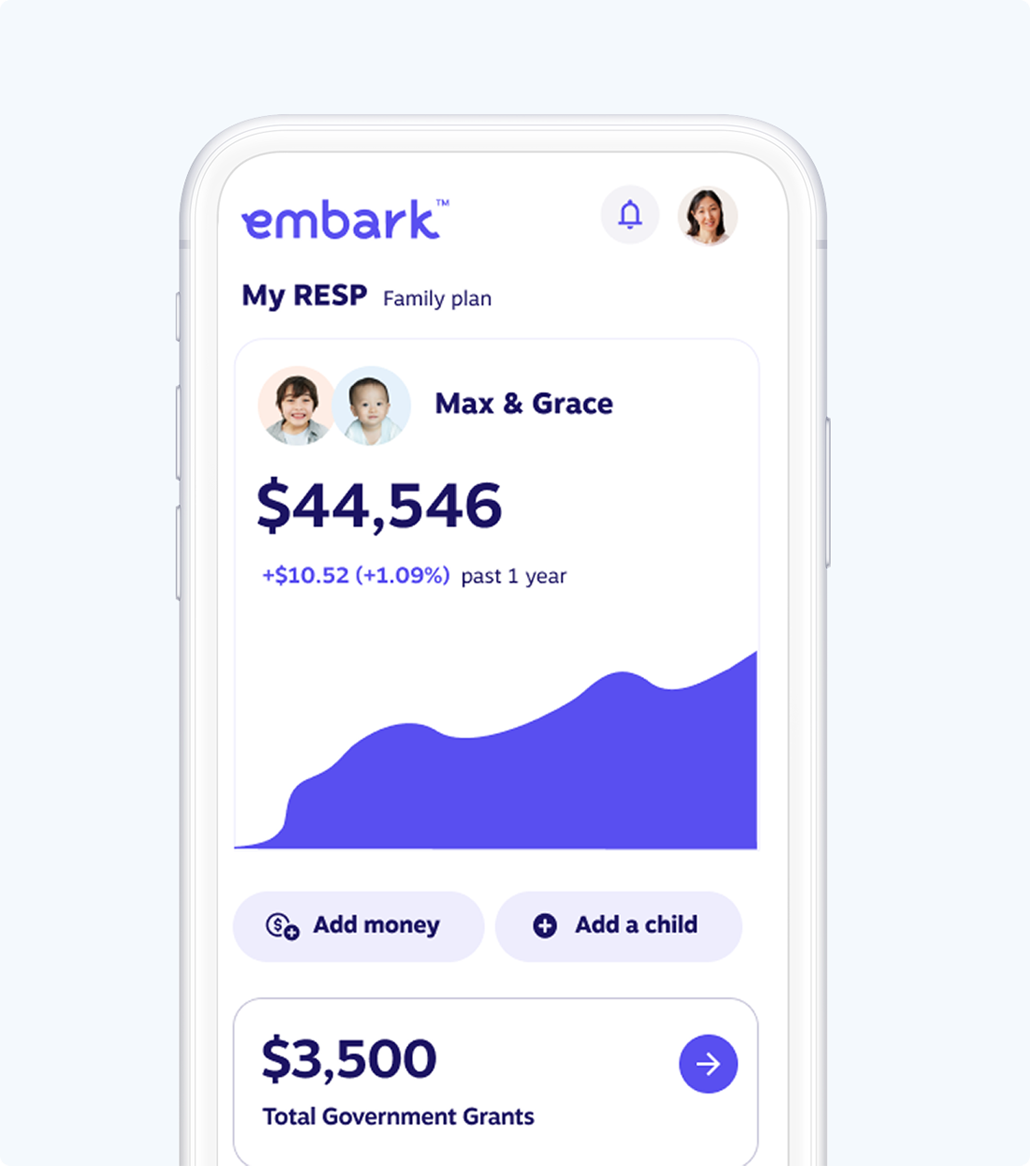

Your RESP Savings

Projected Savings

- $22,000 Contributions

- $4,400 Grants

- $8,907 Income

Average Cost of Education

This projection is based on assumptions and is for illustrative purposes only. Investment returns and actual future value of your RESP cannot be predicted or guaranteed.

The Money Major

Sign up for our newsletter and podcast drops for tips and guidance that help you with education planning, student potential, RESPs and financial literacy and more.