The Embark Student Plan Overview

As of December 31, 2024

How old is your child?

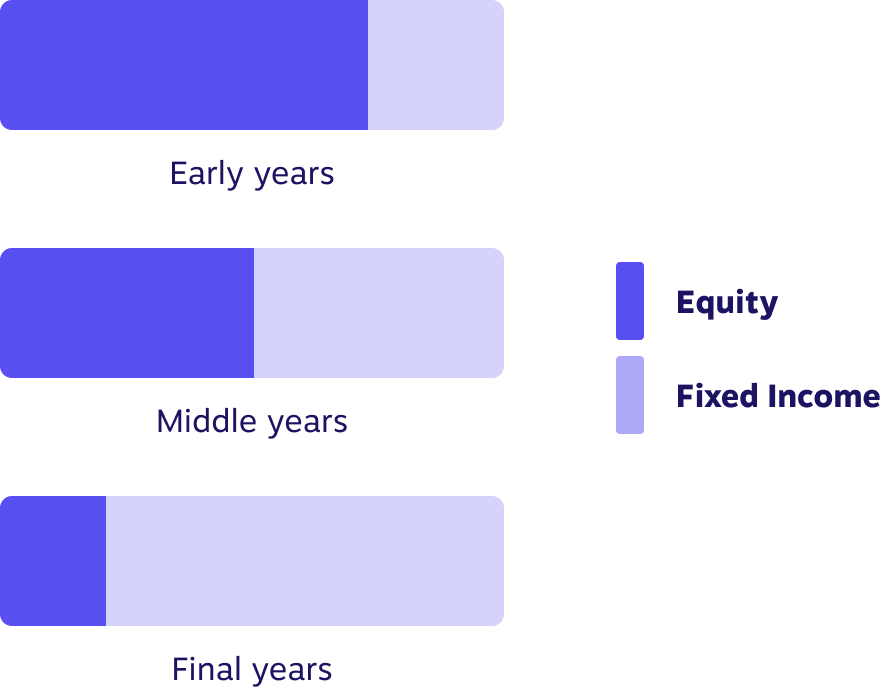

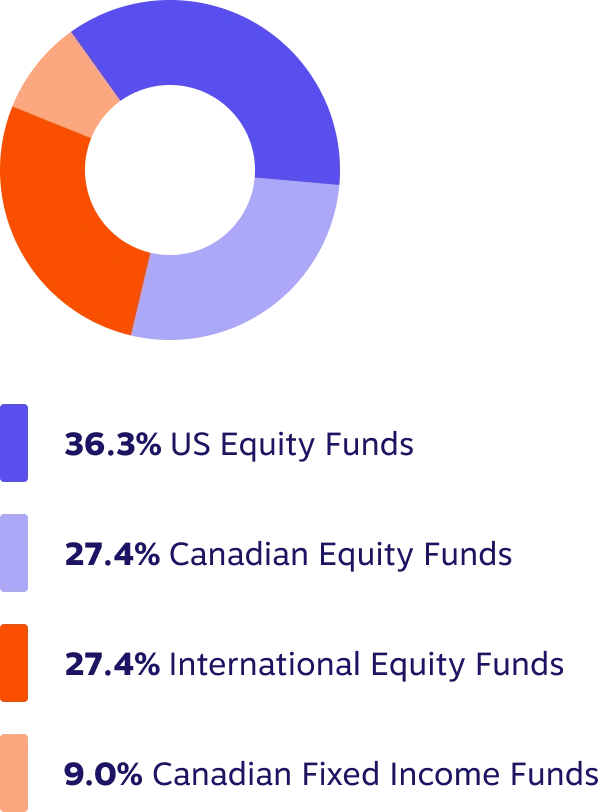

Asset mix

The Embark Student Plan invests primarily in exchanged traded funds. The plan gradually shifts its asset mix from an emphasis on equity funds, in its early years, to an emphasis on fixed income funds as its target date approaches.

Risk rating

We have rated the volatilty of this fund as low to medium.

Portfolio manager(s):

BMO Asset Management Inc.

Quick facts

| Total value of Embark (2044) | $0.769 Million |

| Distributions | Automatically reinvested, quarterly |

| Date series started | March 3, 2023 |

| Minimum investment to start | $0 |

How much does it cost?

The following table shows the fees and expenses you could pay to buy, sell and own units of the Embark Student Plan.

1. Sales charge

Embark Student Plan (2044) units are no load. That means you pay no sales charges if you buy, redeem or switch your units.

2. Fund expenses

You don’t pay these expenses directly. They affect you because they reduce the returns of this series of the plan. As of December 31, 2024, the plans expenses were 1.65% of its value. This equals $16.50 for every $1,000 invested.

Annual rate

(as a % of plans value)

Management expense ratio (MER)

This is the total of the plans management fee (including the trailing commission) and operating expenses.

Trading expense ratio (TER)

These are the plan's trading costs.