Many investors associate bonds with safety or steady income. But what exactly is a bond? This article breaks down how they work in simple terms.

What is a Bond?

A bond is essentially a promise to repay a loan. When investors buy a bond, they are lending money. In return, the borrower (government, company, etc) promises to pay interest (coupon) at regular intervals and return the full amount (called the “principal”) on a set date in the future (called the “maturity date”).

Example:

Suppose an investor purchases a $1,000 bond paying 5% annual interest per year for 5 years. The investor will receive $50 every year for the next five years, and then $1,000 at the end of term.

Why do companies and governments issue Bonds?

Just like people take out loans to buy houses or start businesses, companies and governments sometimes need extra money for different projects. Instead of borrowing from a bank, they can issue bonds to the public.

Some examples of various reasons for borrowing are:

- Governments building new roads and hospitals

- Companies expanding operations or launching new projects

- Refinancing old debts at better interest rates

How does an investor make money with Bonds?

There are two main ways to earn money with bonds:

- Interest Income (also called “Coupon payments”)

- Regular amount of money that investors earn for lending their funds. It’s usually paid annually or semi-annually.

- Capital Gains

- The amount of money that investors earn when selling bonds for more than what they bought for.

For Example:

Purchase price of the bond = $900

Sale price of bond = $950

Capital Gain = $50

Can an investor lose money when investing in Bonds?

Yes, however bonds are usually less risky than stocks. Here are some potential scenarios when bonds could decline in value:

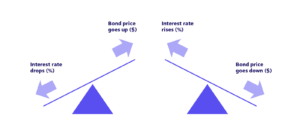

- If interest rates rise, bonds could become less attractive at the current coupon levels, and their market value may drop. Therefore, Interest Rates and Bond Prices move in opposite directions.

- If a company or government that issued the bond has financial troubles, and there is a risk that they may not pay back the money they own.

- Also, the price of a bond might be influenced by other market conditions such as inflation, market sentiment, economic outlook, geopolitical instability, etc.

What types of Bonds are there?

Here are a few common types:

- Government Bonds: Issued by countries’ governments (e.g., Government of Canada bonds).

- Corporate Bonds: Issued by companies. Risk and return depend on the company’s financial health.

- Municipal Bonds: Issued by cities or local governments, such as city of Toronto.

- High-Yield Bonds (a.k.a. Junk Bonds): They offer higher risk and higher potential return.

Why Do People Invest in Bonds?

Here are some reasons why the investors would hold bonds:

- Steady Income: Ideal for retirees or anyone looking for regular cash flow.

- Lower Risk: Compared to stocks, bonds are generally less volatile.

- Diversification: Bonds can help to reducing the overall portfolio risk as they usually have low correlation with stocks.

Consider the following table by Manulife:

Source: Manulife

How bonds and stocks move in relation to each other is important for investors.

- If the correlation is high (close to +1), it means stocks and bonds usually move in the same direction. So, if stock prices go up, bond prices go up too.

- If the correlation is negative (close to -1), it means they move in opposite directions. When stock prices rise, bond prices fall, and vice versa.

- If the correlation is close to zero, it means there’s no clear pattern—sometimes they move together, sometimes not.

The table above shows that both 5-year and 10-year correlation between bonds and stocks is low, meaning they tend to move independently of each other.

What Should an Investor Know Before Investing in Bonds?

Some of the important characteristics of bonds are:

- Credit Rating: Just like people have credit scores, bonds are rated based on the issuer’s ability to pay back the loan.

- The exhibit below shows the ratings scale from one of the major credit rating agencies – S&P Global:

Source: S&P Global Credit Rating Scale

- The Term: Bonds can have different maturities, for example, short-term bonds (1–3 years) vs. long-term bonds (10+ years).

- Coupon: This refers to the periodic interest payment that a bondholder receives from the bond’s issue date until maturity. The interest rate specified is also known as the “Coupon Rate.”

Where can investors buy Bonds?

Investors can purchase individual Bonds of Bond funds.

- Individual Bonds can be purchased directly from the government or corporation that issues them, however, investors will need to work with a financial institution.

- Bond Funds can be bought through an online brokerage account. Bond mutual funds and ETFs include a diversified portfolio of bonds.

Final Thoughts

Bonds can help generate income and reduce risk within investment portfolios —especially when equity markets get bumpy. Whether someone is just starting out or looking to diversify beyond stocks, understanding bonds can help build a more rounded portfolio. Bonds may not be as flashy as stocks, but adding bonds to a portfolio usually provides some predictable income and reduces portfolio’s volatility.

Head of Investments

Yelena Stepanyan is the Head of Investments at Embark. A lover of all things related to the financial markets, she is the past Chair of the CFA Society Toronto's Institutional Asset Management Committee, where she currently serves as a Senior Advisor.