Market Recap* – Week of September 15

1. What happened in the markets?

The Bank of Canada reduced its policy rate by 25 basis points to 2.5%, marking its first rate cut since March. The decision, made unanimously, reflected growing concerns about weakening economic conditions tied to U.S. trade tensions. Similarly, the U.S. Federal Reserve also cut rates by a quarter point and indicated that further reductions may follow, emphasizing economic growth over inflation worries.

Canadian and U.S. equities both pushed higher during the week. The S&P 500 touched record levels following the rate cut. In Canada, the S&P/TSX also climbed to new highs, supported by the Bank of Canada’s own quarter-point cut and by stronger-than-expected factory and wholesale trade data.

International equities followed along though investors were more cautious outside North America as growth concerns lingered.

Canadian bonds held steady over the week. The rate cut supported shorter maturities while longer bonds showed only modest shifts, leaving the overall market essentially unchanged.

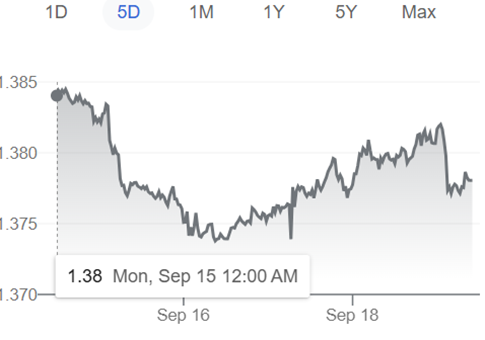

In currencies, the Canadian dollar slightly strengthened vs the Dollar. It first gained on strong economic data but gave back some ground after the Feds joined the BoC in easing policy. By the end of the week, USD/CAD closed at 1.37 however; the greenback showed some signs of recovery – next week will tell if the CAD can maintain its strength.

2. What does it mean for Embark Funds?

| Asset class change | Impact on cohorts |

|---|---|

| Equities ↑ | Positive, especially for younger cohorts with higher equity allocation as strong Canadian and U.S. equity performance lifts portfolio returns. |

| Bonds – stable (prices) | Stable, especially for older cohorts closer to maturity, where assets are heavy on Fixed Income Securities. |

| Money Market – ↑ CAD strengthens | Provided steady returns and stability for near-maturity cohorts, helping to dampen volatility. |

*This market commentary is provided for informational purposes only and does not constitute investment advise. References to financial market performance are based on publicly available data and reflect general conditions during the period noted. Past performance is not indicative of future results, and the impact of market events on the firm’s investments may differ from the broader market.