Market Recap – July

1. What happened in the markets in July?

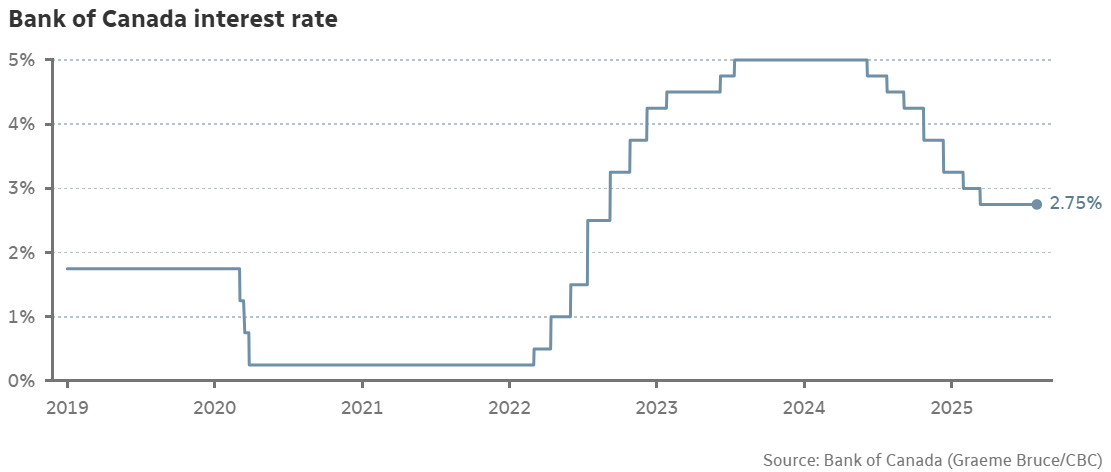

At its July meeting, the Bank of Canada opted to hold the key interest rate steady at 2.75%, citing ongoing economic resilience in the face of global trade uncertainty. Officials acknowledged that while inflation remains persistent, it is currently within manageable levels. The Bank also signaled a continued openness to cutting rates should economic conditions deteriorate.

The U.S. Federal Reserve also voted to maintain its benchmark interest rate, prompting markets to temper expectations for a near-term rate cut.

On the Inflation front, headline CPI rose to 1.9% year-over-year in June, up from 1.7% in May and broadly in line with market expectations.

Equities extended their rally in July, supported by strong second-quarter earnings—over 80% of companies in S&P 500 surpassed analyst expectations. Optimism surrounding U.S. trade negotiations and a rebound in consumer sentiment further bolstered risk appetite.

Canadian Equities rose 1.7%, however sector performances were mixed: Communication Services led the way with a 5.0% gain, while Health Care lagged, declining 6.2%.

U.S. Equities (in CAD) climbed 3.6%. The rally was broad-based, with mid- and small-cap equities advancing in tandem with large-cap names.

International Equities (in CAD) were flat in July.

Canadian bonds declined 0.7% amid ongoing concerns over inflation and slowing growth, while Money market instruments were up 0.2% in July.

2. What does this mean for Embark funds?

| Asset class change | Impact on cohorts |

|---|---|

| Positive Equity returns | Positive equity returns were more favourable for our younger cohorts with higher equity allocation |

| Negative Bond returns | Negative bond returns negatively impacted close-to-maturity cohorts with higher bond allocation |

| Money Market returns | Positive money market returns had a stabilizing impact on close-to-maturity cohorts, reducing the negative impact of bond returns |

| Canadian dollar | Canadian dollar depreciated vs. USD, favorably impacting our foreign equity exposure, especially benefiting the younger cohorts |

*Note: Embark return calculations are finalized in the second part of the month when the RBC data becomes available.

Canadian equities are represented by the S&P/TSX Composite Index

U.S. equities are represented by the S&P 500

International Equities are represented by the MSCI EAFE index

Canadian bonds are represented by the FTSE Canada Universe Bond Index

Money market instruments are represented by the 91 day T-bill