Nova Scotia and Ontario rank as the two most expensive provinces to get an education. Costs are expected to grow by 39% over the next 18 years, leaving many to pay over $100,000 for a four-year degree and residence.

To shed light on the road ahead, we’ve released a forecast of how much an average four-year university degree will cost Canadian students in each province.

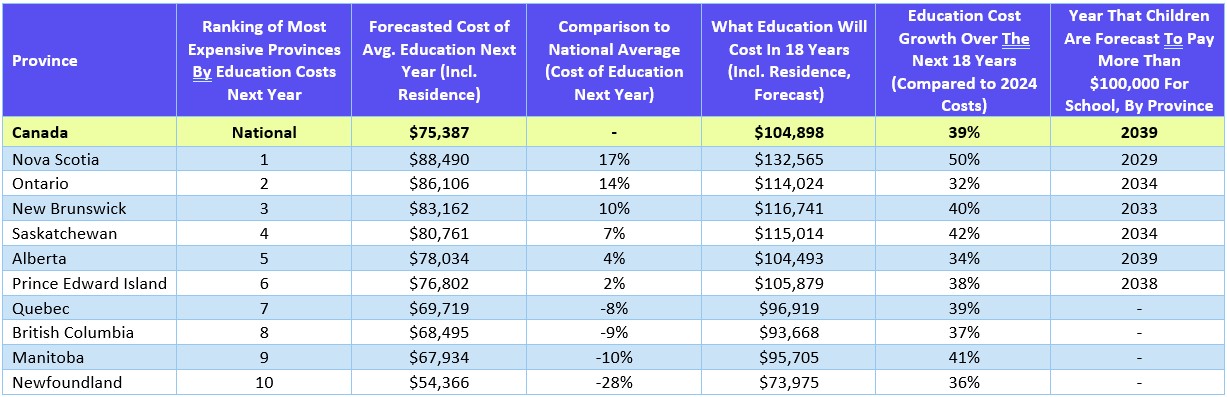

Next year, the average cost of a four-year post-secondary program in Canada will rise to just over $75,000 when factoring in residence costs. This figure is forecast to increase by 39 per cent over the next 18 years, reaching $104,898 by 2041.

For Canadian parents raising Generation Alpha, this means they’ll soon be planning and saving for a six-figure education. Children in certain provinces will reach this mark far sooner, with those in Nova Scotia, Ontario, New Brunswick and Saskatchewan estimated to pay over $100,000 for school within the next 11 years.

When looking at the forecasted cost of a four-year degree and residence for students starting school next year, Canadians in these four provinces are also expected to pay the most, with those in Nova Scotia and Ontario having to pay an average of $88,490 and $86,106, respectively. This is more than $10,000 greater than the national average. On the other end, students in British Columbia ($68,495), Manitoba ($67,934) and Newfoundland ($54,366) are estimated to pay the least.

Understanding how these costs will change and how a registered education savings plan (RESP) can help you save accordingly is key to securing your child’s educational future.

Why University Costs Are Rising

“Post-secondary education is one of the most substantial investments Canadians can make towards their future, but it can also lead to a distressing financial burden,” said Andrew Lo, CEO and President of Embark. “Given that the cost of education has historically outpaced inflation, it is vital for parents and students to not underestimate the associated expenses, and proactively plan for savings at the earliest opportunity to avoid sticker shock when the time comes.”

In recent years, the cost of university tuition fees for both undergraduate and graduate degrees has increased due to numerous factors. From how highly competitive enrolment is and how universities are funded, to a rise in employment costs, and more.

Canadian and International Students

While international students’ fees have historically been used to support tuition costs for Canadian students, with the changing regulations of international student programs, this may no longer be the case.

Tuition Costs vs. Personal Expenses Breakdown

When asked, 31 per cent of Canadian parents did not know enough to even guess how much an education costs today. Those who did guessthought a four-year program cost $62,067. But when factoring in all expenses, this is below the estimated average cost for 2024 in nine of the ten provinces, and over $10,000 off from the national average.

Here’s a general breakdown of Canadian university costs in Canadian dollars below:

- Average tuition fees: $7,000–$9,500 per year

- Living costs: $8,000–$12,000 per year

- Textbooks and other supplies: $1,200–$1,800 per year

- On-campus meal plans: $3,000–$4,500 per year

- Transportation costs: $800–$1,500 per year

- Personal expenses: $2,000–$3,000 per year

Remember, these costs can vary significantly depending on what city students are studying in and whether they live at home.

Regional Variations in Costs for Canadian Students (4-Year Bachelor’s Degree)

Click here for a PDF version of the table found above.

The chart above is ranked from the most to least expensive province for an average four-year university degree and residence. It also projects how much the same education will cost in 18 years, as well as the year that a four-year university degree is expected to exceed $100,000 for each province.

Case Study: Costs in Major Cities

Let’s explore how the cost of post-secondary tuition fees for Canadian students can vary depending on which Canadian city they’re planning to study:

Toronto, Ontario

Tuition at top universities like U of T averages $8,000–$10,000 annually. Residence costs range from $10,000–$15,000 per year, depending on whether the student lives on or off campus. The total estimated cost for four years: $90,000–$110,000.

Vancouver, British Columbia

While tuition is slightly lower, Vancouver’s high cost of living substantially increases housing and food expenses. Estimated total for four years: $85,000–$100,000.

Montreal, Quebec

With subsidized tuition for Quebec residents, costs are lower. The average four-year tuition cost ranges from $60,000–$75,000, making it one of the more affordable cities.

How RESP Plans Offset These Costs

What’s more, many Canadian families are leaving government grant money on the table. The Canada Education Savings Grant (CESG) matches 20% of what you contribute to an RESP every year, giving you up to an additional $500 in savings annually and up to $7,200 over the lifetime of your plan. Another grant, called the Canada Learning Bond (CLB), offers families with modest incomes money for just opening an account. No contributions are required to receive it if you fall within the eligible income requirements. One of the key benefits of the CLB grant is that it can be received retroactively, as long as you apply.

“In order to maximize education savings, it’s important to leave no stone unturned. We saw that less than half of parents know about the CESG, which means most Canadians are missing out on government money that they are entitled to,” said Lo. “At Embark, we have a strong commitment to ensuring that every possible opportunity and advantage is utilized to assist Canadians in saving for their education. Our unwavering focus is on optimizing education savings and empowering students to achieve their goals without the burden of overwhelming debt.”

What Saving Could Look Like

A feasible savings plan is essential for families because even small, consistent contributions can add up significantly over time and help avoid going into debt as you save for your child’s education. For example, if both parents start contributing $50 per month to an RESP when their child is born, they could accumulate approximately $37,000 by the time their child turns 18[2], when accounting for grants and a four per cent rate of return.

Now, let’s say this family increases their monthly contributions to $100 each. In this case, the value of their RESP could reach $65,000 over 18 years, which shows how compound interest and grant money can substantially benefit your child’s future university tuition fees. Remember, RESP accounts are tax-sheltered, and your investment portfolio can be tailored to fit your risk tolerance and your child’s age, ensuring you optimize your savings in the long-term.

Tips for Smart RESP Strategy

Embrace the power of time

Starting your savings journey at any age is possible, but the sooner you begin, the more time your money has to grow and flourish. Consider placing your funds in a tax-sheltered savings account, such as an RESP, to benefit from compounding growth. To get an estimate of your potential savings growth, explore our online calculator.

Practical savings go a long way

While times are tough, funding your child’s education savings does not have to fall completely on your shoulders. For instance, the government will boost your contributions through grants, giving you an extra 20 per cent in savings on your first $36,000 contributed, if saved correctly. Beyond grants, using gifted money from birthdays, Christmas, or other special occasions is a great way to add funds to your child’s RESP.

Save proactively and strategically

When asked, 68 per cent of students said they wish that they had saved more before going to school. Students should talk to their parents early to see if they will help pay for their education and understand how much will be needed. While it may not seem fun at the time, it will help in the long run to try and save independently. In high school, try putting a portion of a part-time or summer job pay cheque away as education savings. An automatic contribution can make it even simpler and will ensure a certain amount is put away regularly. Remember that student loans and scholarships also exist.

Monitor and adjust annually

When it comes to saving for your child’s future academic achievements, contributing to an RESP is not something you should automate and forget about. The best thing you can do is review your portfolio contribution schedule, grant eligibility, and risk tolerance each year. Doing so can help you maximize your savings and ensure you stay on track for your tuition goals.

A little guidance goes a long way

73 per cent of students wish they had more guidance when planning their post-secondary education. Take time to truly think about what you want to do and talk to people about it. Talk to guidance counsellors and experts to learn more about different career paths, whether that is a university, college, or a trade school. You can also try to ask someone who is in that field for firsthand insight.

To learn more about how Embark can help parents save more, go to www.embark.ca.

[1] The forecasted figures found within this table are estimates based on data published by the Employment and Social Development Canada’s (ESDC) Canadian Post-Secondary Institution Collection (CPIC) database. This information, including tuition fees, are updated by the ESDC on an annual basis and are subject to change.

[2] This projection is based on assumptions and is for illustrative purposes only. Investment returns and actual future value of your RESP cannot be predicted or guaranteed.

Embark is Canada’s education savings and planning company. The organization aims to help families and students along their post-secondary journeys, giving them innovative tools and advice to take hold of their bright futures and succeed.